How to Build Assets That Compound (Even When Life Forces You to Pivot)

A founder’s playbook for turning setbacks into leverage that lasts.

Most entrepreneurs are told the same story: work harder, grind longer, and stack more tactics. But hustle is fragile.

When the storms come, and it always does, hustle collapses.

I know this because I’ve lived it.

I launched a private finance business in 2005. By 2008, I watched it evaporate in front of me during the financial crisis. Seven years later, I acquired, renovated, and rebranded an extended stay hotel, only to run headfirst into the COVID lockdown. In 2021, I started a business accelerator academy funded by government funds allocated to help entrepreneurs weather the aftermath of the Covid lockdown. After graduating 47 businesses and coaching a few dozen more, the program had to stop due to a reallocation of government funds.

If you ever need someone to pick the worst timing for a business, I’m your guy. But here’s the thing, each of those stories ended in remarkable success. That’s why I’m writing this article. Let me walk you through it.

Build to Thrive

Here’s my motto. Build Assets. Create Freedom. Thrive on your terms.

Build assets, because assets create leverage. Leverage multiplies your income regardless of your effort. In other words, your income is not directly correlated to the time you spend doing the job.

Here’s how the story of a business goes:

You work for months (or years) building momentum.

One shift in the market, in your personal life, or in the economy, your business gets wiped out. (About 90% of startups fail, CB Insights / 49% of small businesses make it beyond the 5th year. Small Business Administration)

You’re left wondering if all your effort was wasted. (Ever have this feeling?)

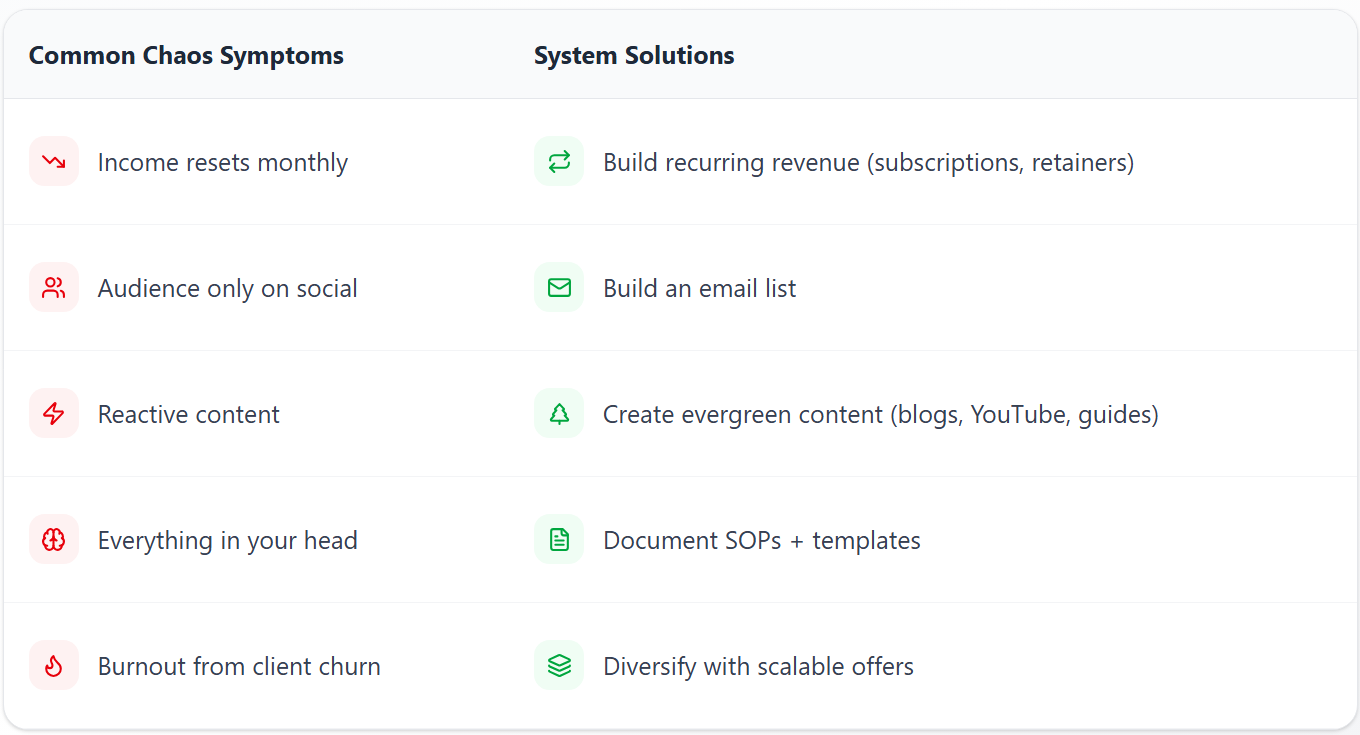

The truth is that many founders are unknowingly building disposable assets. Those that vanish the moment you stop working, a client leaves, a platform changes its algorithm.

But there’s another path. Assets that compound across businesses.

Assets the Compound

Compounding is the process where an initial amount of money (or effort, or knowledge) grows over time because bother the original amount and the accumulated growth generate more growth. In other words, you earn return on the original amount plus the returns from the previous periods

James Clear, who wrote the bestseller, Atomic Habits, shows how the power of habits compound by using this formula:

Future Value=(1+r)^n

Where:

r = the rate of change (e.g., 1% better = 0.01, 1% worse = –0.01)

n = the number of periods (e.g., days, weeks, years)

Clear uses it to show how small daily improvements or declines stack up over time:

1% better every day for 1 year:

(1+1%)^365 = 37.78

So you’re ~37x better by the end of the year.

Let’s navigate through the 6 types of compounding assets.

1. Intellectual Property & Systems

Playbooks, frameworks, methods, and systems that let work scale beyond one person.

Compounding effect: Once built, each new project or clients adds to the library, saving time and multiplying value delivery.

In my case, I have a depository of all the tools, tech, tactics and prompt that I use and/or recommend to business founders, you can look in up here.

Other examples:

A signature framework turned into a digital course.

A library of evergreen content (blog posts, newsletter archives, playbooks).

An automated onboarding system for new clients.

Recommended readings:

Scaling Smart: 5 Systems Every Solopreneur Needs to Grow Without Burning Out

AI Is Here. Let’s Get Your Business in the Game.

2. Relationships

Networks of trust, credibility, and goodwill.

Compounding effect: Each connection opens doors to more opportunities, introductions, and resources provide an exponential growth loop.

Community partners who refer tenants to our buildings.

An investor who funds multiple ventures over the years.

A fellow founder who sends referrals when they’re overbooked.

Recommended reading: How to Build Relationships with Investors (Family Offices, Ultra-High Net Worth)

3. Reputation

Trust multiplies without reintroducing yourself.

Compounding effect: trusts precede you. People hear about you before they meet you. Each positive interaction adds to a reservoir of credibility, which then makes the new introduction faster and smoother.

Being known as the operator who can navigate chaos.

Publishing stories of lessons learned, attracting aligned clients.

Awards or recognition.

4. Capital

Money, but also the ability to attract and deploy it.

Compounding effect: Well-allocated capital grows while funding the creation of more assets in all other categories.

Equity stakes in businesses or partnerships.

Real estate holdings that serve as collateral to a bank loan, leveraging your capacity to grow as you invest in other assets.

5. Skills

Expertise, judgement and craft you sharpen over time.

Compounding effect: Each skill builds on others (like stacking blocks), making you uniquely valuable in ways that can’t be easily copied.

Financial modeling learned in lending, repurposed in real estate.

Negotiation skills learned in deals, later applied to partnerships.

Coaching/facilitation skills developed in accelerators, now used with founders.

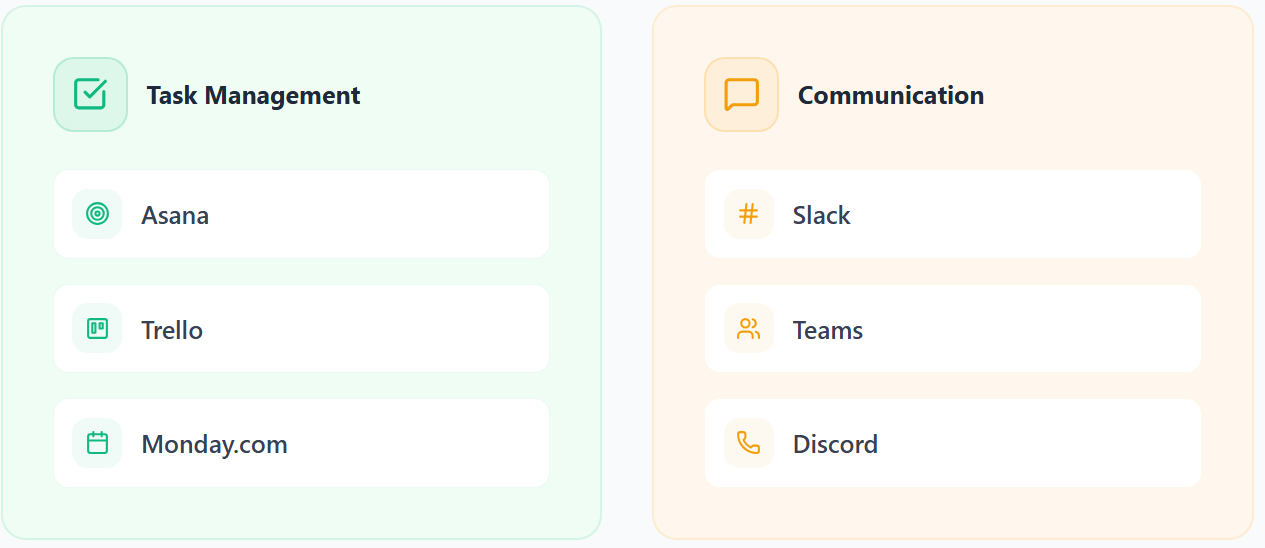

6. Time and Energy Systems

Habits, rituals, and tools that protect focus and optimize energy.

Compound effect: Every cycle of improved productivity frees capacity that can be reinvested in higher value work.

A weekly “Big 3” planning rhythm that keeps you focused.

Documented SOPs that free you from repetitive decisions.

Daily routines (exercise, reflection) that preserve energy for strategic work.

The Pivot Principle: Turning Setbacks Into Leverage

Crises have a way of teaching you the truth the hard way. These are moments that cornered you, that force you to fight for survival. I call them PHDs. You learned a lot! You graduate to a new level. Unfortunately, unlike PHDs you don’t get a degree or title, and it’s not something you want to add to your resume. It can make the difference in a job interview though…

Every collapse in my journey forced me to pivot, but the assets I’d built softened the blow:

When my private finance business collapsed in 2008, I pivoted into real estate development. The financial knowledge and the portfolio of foreclosed properties I’d acquired, kept paying dividends. Years later, this real estate business and portfolio sold for $19M dollars on a $3M dollar investment. If you like to learn more, here is an article about it: The Accidental Developer

When my extended-stay hotel was suddenly empty during Covid lockdown. Because I had nurtured strong community relationships, I was able to rent the property to organizations relocating people during COVID. Those relationships literally kept me afloat. Years later the hotel sold for $15M dollars on a $2.4M dollar investment. If you like to learn more, here is an article about it: The Extended-Stay Turnaround: Strategy, Grit and Returns

Education funding dried up: The frameworks and my coaching skills survived and became tools I now use to launch my 5th business (Going though it’s 5th month) Buildtothrive.co and help business founders’ grow their businesses. If you think I can help you with a business challenge, click below and send me a message. I will try to do my best to help you think through it.

That’s the principle: don’t just survive the pivot use it to create something that compounds.

Step-by-Step Guide to Building Compounding Assets

Intellectual Property & Systems

Spot the Bottleneck

Ask: What keeps me stuck in the hustle loop?

For most solopreneurs, it’s trading time for money or chasing too many tactics.

Translate It into a System

If you repeat something, systematize it. Write it down, automate it, or productize it.

Example: A coaching call becomes a recorded workshop.

Layer Your Assets

Stack them so each one feeds the next.

A workshop → digital course → consulting framework → community.

Protect & Repeat

Shiny objects drain compounding power. Protect your existing assets and keep layering.

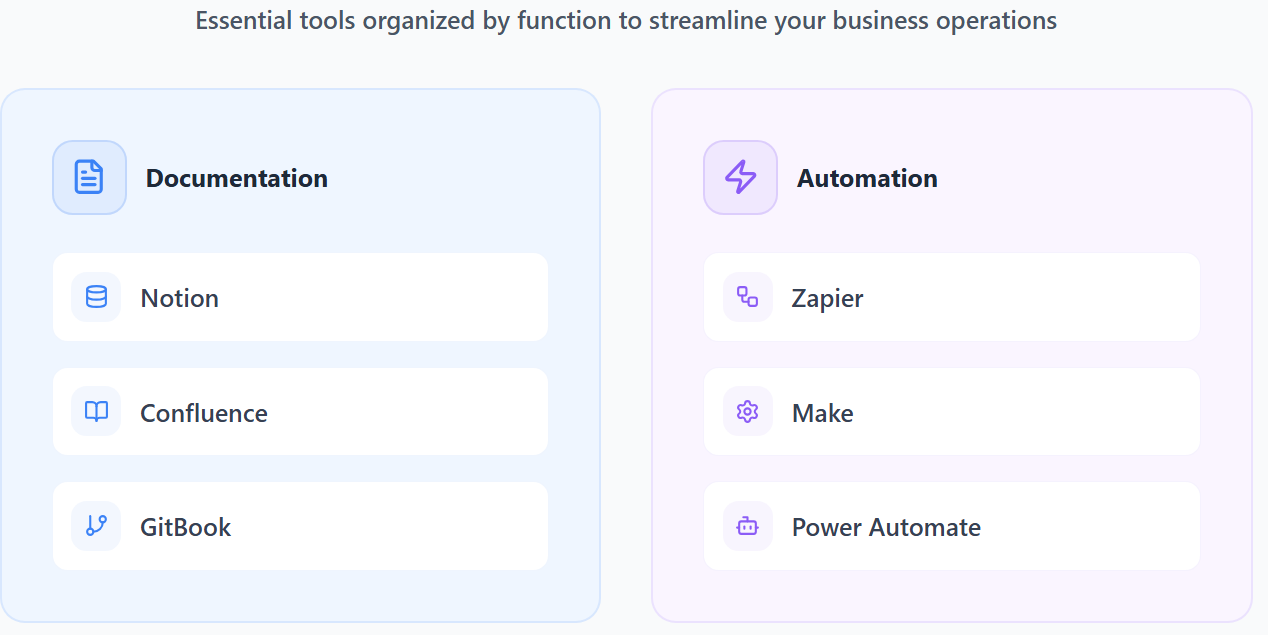

Tools & Resources to Accelerate Compounding

Different types of solopreneurs can lean on different tools:

For Freelancers

ConvertKit – Email marketing + simple automations [link].

Notion – Process documentation, client portals [link].

For Agencies

For SaaS Builders

HubSpot Starter – CRM + relationship management [link].

Beehiiv – Newsletter platform for audience-first SaaS growth [link].

For Creators / Educators

Circle – Community platform that compounds engagement [link].

Podia – Digital product sales + courses [link].

But systems and IP are just one kind of compounding asset. But the others: relationships, reputation, capital, skills, and time/energy, often matter even more in a storm. They don’t live in apps or checklists, but they’re what actually saved me when finance collapsed, hospitality shut down and education funds dried up. Let’s look at those next.

I use this space to share ideas and voices that help founders and creators think more clearly, act more intentionally, and build systems that last.

My work focuses on helping entrepreneurs bring order to growth and clarity to complexity, moving from chaos to control, and from control to sustainable growth.

If this resonates with you and like to learn how we can work together, visit my website below.

Relationships

The asset that gets stronger in storms.

Relationships are often the difference between collapse and survival.

In 2020, my extended-stay hotel sat empty. But because I had nurtured community ties, I was able to rent to organizations relocating people during lockdown.

Those contracts didn’t come from ads, they came from trust.

How to Build It

Give value before you need it.

Show up consistently.

Keep records of who you know and how you can help.

Tool Tip: Use a lightweight CRM like Clay or Notion to track and nurture connections.

Reputation

The silent multiplier.

Reputation compounds in the background, then pays off all at once.

After the 2008 financial collapse, my ability to navigate chaos became part of my reputation. Investors trusted me because I had scars, not because I had a glossy pitch deck.

How to Build It

Do what you say you’ll do.

Publish your lessons (wins and losses).

Protect credibility as fiercely as you protect capital.

Tool Tip: Share your journey through platforms like Substack or LinkedIn to let your reputation compound in public.

Capital

The fuel that buys time and optionality.

Capital isn’t the only game, but it’s the buffer that lets you pivot and experiment.

My early real estate portfolio wasn’t just income — it was dry powder when everything else stalled.

How to Build It

Diversify income streams.

Protect cash flow with recurring revenue.

Reinvest profits into durable assets (equity, property, or tools that scale).

Tool Tip: Use something simple like Wave or QuickBooks to track cash and keep an eye on margins.

Skills

The portable asset you carry everywhere.

Skills sharpen under pressure and travel across industries.

Finance collapsed, but the financial modeling skills carried straight into real estate development.

Same tool, new arena.

How to Build It

Treat every crisis as training.

Document what you’ve learned.

Translate skills into frameworks others can use.

Have a lifelong learning mindset. Best investment you will ever make.

Tool Tip: Use Loom or Notion to capture processes as you refine them — each becomes a building block for future IP.

Time & Energy Systems

The container that keeps everything compounding.

Without boundaries, all other assets leak. Time and energy systems protect the attention you need to keep building.

For me, documenting SOPs, using project tools, and setting personal rhythms created space to grow instead of react.

How to Build It

For me is about defining my “big three” annual, quarterly, monthly and weekly priorities.

Batch repetitive tasks.

Protect your health like it’s your core business asset.

Tool Tip: Use Reclaim.ai or a simple weekly planner to keep time aligned with priorities.

Closing Reflection

Freedom doesn’t come from working harder. It comes from building assets that keep working for you.

That’s the lesson I carried through finance, real estate, hospitality, and education. In each case, the storm didn’t end me, it gave me the chance to double down on assets that would last.

The storms don’t stop coming. But each one leaves behind the chance to build something stronger.

Build assets. Create freedom. Thrive on your terms.

Juan M Salas-Romer

Check out the Vault. My growing inventory of tools, apps, tactics and prompts to build and scale smarter.

Great strategies Juan. So important to stay informed

Wow well explained