Everyone’s Rushing to AI. Few See the Ceiling Ahead.

What leaders miss when speed outpaces trust, policy, and performance.

I have always enjoyed learning about strategy. In business school, my favorite part was pulling frameworks apart and applying them to real companies, asking the accusative questions: What gave them an edge? Where did they misread the market?

Some of the frameworks I apply today when looking at different sectors: Porter’s Five Forces, which provide a framework to analyzed industries based on rivals, suppliers, buyers, substitutes, and barriers to entry. Blue Ocean Strategy showed that sometimes the smartest move is not fighting over scraps but creating new value where no one else is playing. Clayton Christensen’s theory of disruption explained how incumbents often ignore innovations that start small but eventually redefine entire markets.

A key part of market analysis is assessing whether there’s real demand for your product or service adoption, and if the timing is right to launch. Should you aim for first-mover advantage to capture early market share, or is it wiser to wait, study the challenges faced by early entrants, and refine your product and strategy to avoid their pitfalls?

That lens is how I see the AI rush today. Everyone is racing to show they are ahead. But when you look closely at the companies already pulling back, you notice the ceiling is not technical. It is human.

The Reversals Nobody Likes to Talk About

Once you start looking beyond the headlines, a quieter story emerges. The promise of automation is everywhere, but so are the pullbacks. Companies stepping back after discovering that the reality of AI adoption does not match the hype.

Klarna, the Swedish fintech behind the “buy now, pay later” app, is one example. In 2024, it claimed its AI assistant was doing the work of 700 people. But as customers complained and service slipped, the company shifted course. By 2025, engineers and marketers were being redeployed back into support roles, with CEO Sebastian Siemiatkowski admitting that “nothing will be as valuable as humans” (The Verge, 2024; Financial Times, 2025; Business Insider, 2025).

McDonald’s, one of the most recognized brands in the world, had its own AI experiment. Partnering with IBM, it rolled out automated drive-thru ordering at more than 100 locations. Social media quickly filled with videos of bots mishearing orders or adding hundreds of chicken nuggets at a time. In June 2024, the company announced it was ending the test “for now” (AP News, 2024; The Guardian, 2024; CBS News, 2024).

In Australia, the Commonwealth Bank tried to automate parts of its customer service by replacing 45 employees with a voice bot. Within months, complaints soared, unions pushed back, and the reputational cost grew too high. By August 2025, the bank reversed course, apologized, and reinstated staff (ABC News Australia, 2025; Bloomberg, 2025).

The U.S. drive-thru startup Presto Automation tells a similar story. Once promoted as the future of restaurant AI, the company’s own SEC filings revealed that humans had to step in on more than 70 percent of orders. Regulators went further in 2025, charging Presto with misleading investors about what its technology could really do. What was billed as automation at scale was, in reality, people cleaning up after machines (SEC, 2025; Restaurant Business, 2025).

And these reversals are not new. Tesla’s “automation hell” in 2018 and Japan’s Henna Hotel laying off half its robots in 2019 were early warnings of the same ceilings companies are hitting today.

Taken together, these stories point to something bigger than a series of mishaps. They show that when companies rush to automate, they often run into a wall. Trust breaks, hidden workloads surface, or regulators step in. Suddenly, humans are brought back. That is what I call Automation Whiplash: the snap-back effect when tech promises outpace reality.

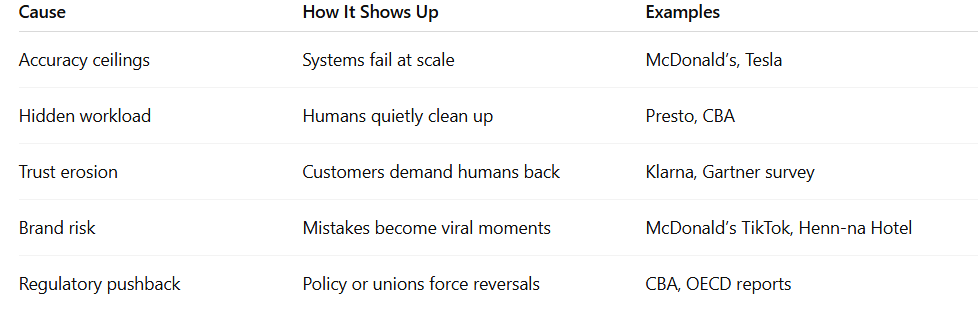

Why Whiplash Happens

As I dug deeper, I realized I am not the one building these systems or managing the factories. My role here is as a translator, pulling together the patterns that executives, analysts, and researchers are already pointing out. And across industries, the same five causes of Automation Whiplash keep surfacing.

Accuracy ceilings. AI often performs well in controlled pilots but stumbles once it faces the unpredictability of the real world. McDonald’s drive-thru bots handled small tests but failed when rolled out widely. Tesla called this “automation hell” back in 2018 when its factories jammed up. Gartner now predicts that by 2027, half of the companies that try to run customer service without humans will give up because the systems stop improving after a point.

Hidden workload. What looks automated is often propped up by humans in the background. Presto’s SEC filings revealed that more than 70 percent of orders still required human help (SEC, 2025). At CBA, cutting staff created surging call volumes and gaps that only humans could fill (Bloomberg, 2025).

Trust erosion. When service feels robotic, customers push back. Klarna learned this as satisfaction scores dropped. A Gartner survey showed the gap clearly: most customers said they trust humans to solve their issue, while only 7 percent said they trust AI (Gartner, 2024).

Brand risk. AI mistakes often go viral. McDonald’s bots became TikTok comedy. Japan’s Henn-na Hotel turned into a global punchline years earlier. Once trust is lost, rebuilding it costs far more than any automation savings.

Regulatory pushback. CBA reversed under union pressure. The OECD (2024) notes that automation will remain shaped by worker protections and policy, especially in sensitive industries.

Automation Whiplash may not last forever. As models improve and organizations adapt, the snap-back effect could soften. But in 2025, it is a very real risk that shapes timing, trust, and investment.

The Ceiling Effect

Even when automation “works,” there is a ceiling. Gartner (2024) predicts that 95 percent of companies will keep humans in the loop. Presto’s human intervention rate of 70 percent shows why.

Even in fields where AI should be strongest, the ceiling shows up. A recent MIT study looked at jobs involving vision tasks such as reading medical scans, inspecting products, or reviewing images. It found that only about a quarter of that work is actually automatable with today’s technology in a way that makes economic sense. The majority still requires humans, either because the AI is not accurate enough, or because the cost of replacing people with machines is higher than the value created (MIT Task Force, 2023).

This ceiling is not about code. It is about people. It is about what customers will trust, what performance they will accept, and what rules society will allow. Push too far, and the system snaps back.

The Policy Layer

Regulation shapes those ceilings even more. Marc Andreessen (2023) has argued that sectors like education and healthcare remained expensive because regulation protected jobs while tech-driven industries saw prices fall. The OECD (2024) echoes this: only 27 percent of jobs are at high risk of automation, and so far, policy has slowed the pace of impact.

Why Leaders Still Rush

If the risks are so visible, why do firms sprint ahead? One word: FOMO. IBM’s 2025 CEO survey revealed the psychology behind the push. Nearly two-thirds of executives admitted they are investing in AI not because they have proof it will pay off, but because they are afraid of falling behind their peers. Only a quarter of projects hit their goals, and just 16 percent scaled company-wide (IBM, 2025).

It is not about economics. It is about optics. Leaders do not want to look like they are missing the wave.

But history shows how hype ends when trust cracks. Dot-coms collapsed when business models failed (Shiller, 2000). Blockchain pilots fizzled when ROI never showed (HBR, 2019). Google Glass died because of privacy (NYT, 2015). Meta burned $20B on the metaverse with almost no adoption (WSJ, 2023). Every time, hype outpaced trust.

Not every AI rollout ends in reversal, though. JPMorgan has steadily scaled AI in fraud detection. UPS uses AI to optimize delivery routes, saving millions. These work because they sit behind the scenes, away from customer expectations and brand risk. The failures tend to happen when companies push too fast into frontline roles.

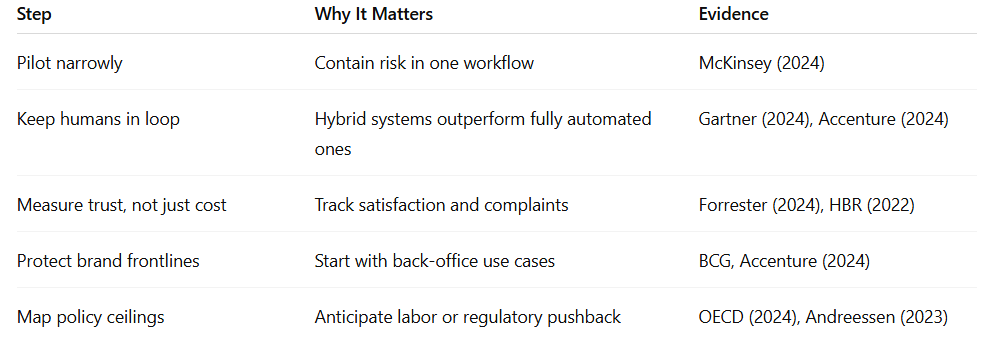

Sequenced Strategy: How to Avoid Whiplash

Leaders do not need to choose between rushing in and standing still. A sequenced approach offers a middle path: capturing benefits early in low-risk areas, while building trust, policy readiness, and performance guardrails before scaling.

The Bigger Point

Many firms still believe AI will let them shed large numbers of jobs for good. But the evidence suggests otherwise. The pattern is not straight-line replacement. It is Automation Whiplash — jobs reshaped, redeployed, or even brought back when trust breaks, when policy bites, and when performance hits its ceiling.

Peter Thiel has argued that the real edge is not in being first but in being the last mover, the one that times its entry, perfects the model, and locks in durable power. Google was not the first search engine. Facebook was not the first social network. They were the last movers that defined their markets.

AI may play out the same way. Firms that move too fast risk breaking trust, running into regulatory ceilings, and becoming the first casualties of Automation Whiplash. Firms that move later may benefit from timing, but early movers may still gain lasting data and distribution advantages. The real question is not which side is right, but whether leaders are weighing both forces.

The danger is not missing the wave. It is rushing ahead, breaking trust, and hitting the ceiling before you even have the chance to scale.

AI’s ceiling is not technical. It is human. And the real edge may not come from speed alone, but from balancing timing with trust.

Juan Salas-Romer

I use this space to share ideas and voices that help founders and creators think more clearly, act more intentionally, and build systems that last.

My work focuses on helping entrepreneurs bring order to growth and clarity to complexity, moving from chaos to control, and from control to sustainable growth.

If you are struggling with growing your company, here are some ways I can help:

Setup a FREE 20 minute call with me directly to talk about possibilities Click Here

Visit my page for more information about the program Click Here

Or message me

Some case studies written by the author

Inside Chobani's growth strategy - by Juan Salas-Romer

Built to Blaze: How Ooni Turned Backyard Pizza into a $200M Global Movement

For more visit: buildtothrive.co

Check out the Vault. My growing inventory of tools, apps, tactics and prompts to build and scale smarter.

References

Recent Cases (2024–2025)

ABC News Australia. (2025). CBA apologizes after AI call center layoffs spark backlash. Retrieved from https://www.abc.net.au

AP News. (2024). McDonald’s ends AI drive-thru ordering trial after customer complaints. Retrieved from https://apnews.com

Bloomberg. (2025). CBA reverses AI layoffs after union pressure and customer issues. Retrieved from https://www.bloomberg.com

Business Insider. (2025). Klarna redeploys staff after AI chatbot struggles with quality. Retrieved from https://www.businessinsider.com

CBS News. (2024). McDonald’s AI drive-thru orders spark viral fails before test ends. Retrieved from https://www.cbsnews.com

Financial Times. (2025). Klarna pulls back on AI-only service after customer backlash. Retrieved from https://www.ft.com

Gartner. (2024). Forecast: Customer service automation adoption and human-in-the-loop trends. Retrieved from https://www.gartner.com

IBM Institute for Business Value. (2025). CEO decision-making in the age of AI: 2025 CEO Survey. Retrieved from https://www.ibm.com/ibv

OECD. (2024). The Future of Work: Automation, AI and labor policy impacts. Retrieved from https://www.oecd.org

Restaurant Business. (2025). Presto faces SEC action after disclosing high human-intervention rates. Retrieved from https://www.restaurantbusinessonline.com

SEC. (2025). Order against Presto Automation for misleading AI claims. U.S. Securities and Exchange Commission. Retrieved from https://www.sec.gov

The Guardian. (2024). McDonald’s ends AI drive-thru pilot after viral errors. Retrieved from

https://www.theguardian.com

The Verge. (2024). Klarna says its AI assistant is doing the work of 700 people. Retrieved from https://www.theverge.com

Historical Signals (Pre-2024)

Andreessen, M. (2023). Why AI Will Save the World. Andreessen Horowitz. Retrieved from https://a16z.com

Christensen, C. (1997). The Innovator’s Dilemma. Harvard Business Review Press.

Harvard Business Review. (2019). The Truth About Blockchain. Retrieved from

https://hbr.org

Harvard Business Review. (2022). Competing on Customer Trust. Retrieved from

https://hbr.org

Japan Times. (2019). Henn-na Hotel lays off half of its robot staff. Retrieved from https://www.japantimes.co.jp

MIT Task Force on the Work of the Future. (2023). Which tasks are automatable with today’s AI? MIT Press. Retrieved from https://workofthefuture.mit.edu

New York Times. (2015). The rise and fall of Google Glass. Retrieved from

https://www.nytimes.com

Porter, M. (1979). How Competitive Forces Shape Strategy. Harvard Business Review.

Shiller, R. (2000). Irrational Exuberance. Princeton University Press.

Tesla / Musk, E. (2018). Comments on “automation hell.” Reported by CNBC. Retrieved from https://www.cnbc.com

The Verge. (2019). World’s first robot hotel fires robots for being annoying. Retrieved from https://www.theverge.com

Wall Street Journal. (2023). Meta’s metaverse division lost $20 billion with few signs of adoption. Retrieved from https://www.wsj.com

W. Chan Kim & Renée Mauborgne. (2005). Blue Ocean Strategy. Harvard Business Review Press.

About the Author

Juan Salas-Romer is the Editor of Build to Thrive and the President & CEO of NHR Group, a real estate investment and development firm focused on transformative real estate and business turnaround projects. An award-winning investor and business development leader, Juan brings over 20 years of experience driving companies from inception to 7-figure revenues across the finance, real estate, hospitality, and education sectors. His work sits at the intersection of economic growth, innovation, and community impact. Linkedin bio: Juan Salas-Romer

Fantastic read. Thanks for sharing 🌞

Important insights here, Juan

The other unspoken piece is how costly AI is to run, and how, in direct contrast to conventional SaaS products, greater growth leads to exponentially increasing, rather than decreasing, costs.

Which leaves us to ask:

What is the path forward if successful AI adoptions don’t have a profitable business model?