How to Transform Blighted Properties Into High-Value Assets

A Developer’s Playbook for Value-Added Real Estate Investments

Build to Thrive is your go-to for business & real estate insights—stories, playbooks and trends. We spotlight trailblazers & deliver actionable strategies to drive success. No fluff, just useful stuff!

Key Concepts:

#UrbanReinvestment | #ValueAddDevelopment | #NeighborhoodRevival

#RealEstateStrategy | #ExecutionPlaybook | #VisionToReality

Have you ever walked through a city and imagined the untapped potential of a neglected property? How could the neighborhood be transformed, bring new energy to the community, and create lasting value? And more importantly—what would it take to turn that vision into reality? If you have an entrepreneurial mindset, chances are you see this not just as a challenge, but as an exciting opportunity to build something meaningful while generating strong returns.

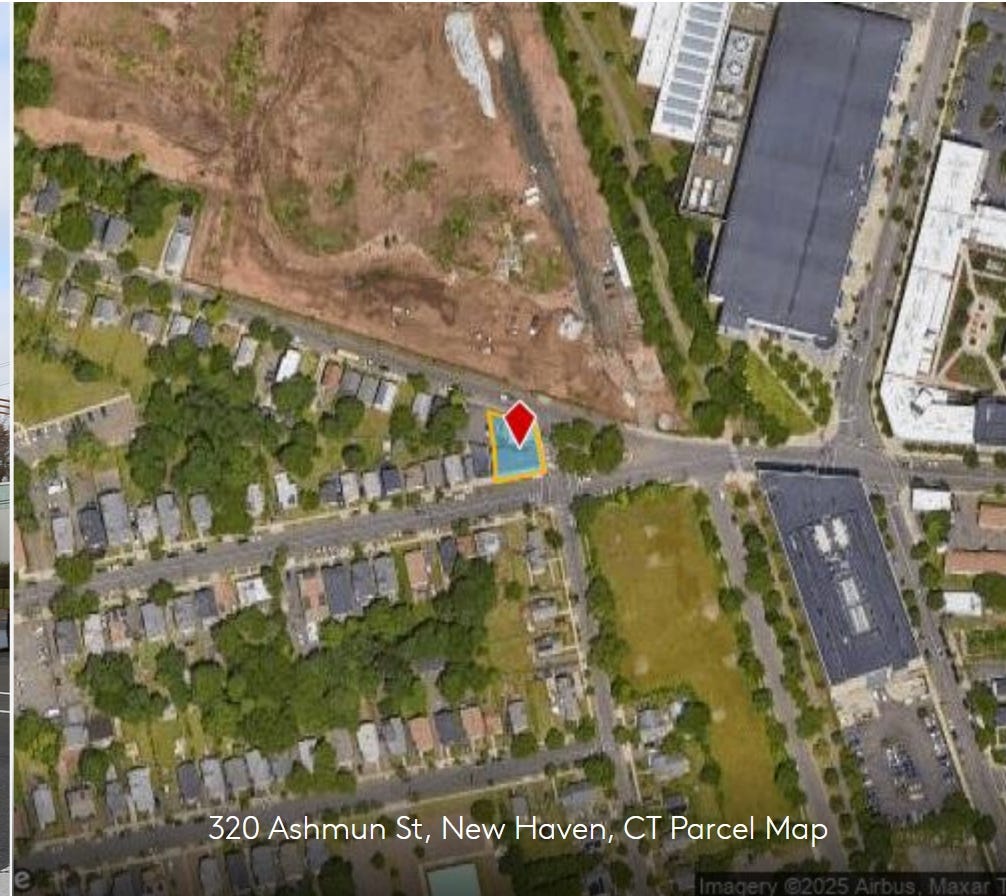

This is what I saw in front of my eyes at the crossroads of Ashmun, Henry, and Munson Streets in New Haven: a blighted church, a struggling two-family home, a run-down bar, and an underutilized lot—all waiting for a second chance. This unique intersection, linking Yale University, Science Park, and the historic Dixwell neighborhood, presented the perfect opportunity for thoughtful redevelopment that could bridge communities and unlock untapped potential.

In this edition of Build and Thrive, we’ll break down the process of value-added investing to transform several properties into a thriving 8-unit residential development and a retail store front.

Join me as we walk through a developer's playbook for investing in, transforming, and bringing new life to these properties—turning overlooked spaces into thriving, high-value assets.

1. Developing an Investment Thesis

I have always been a market-driven investor, meaning I don’t restrict myself to a single property type. Instead, I focus on demand trends, neighborhood growth potential, cap rates, and overall yield opportunities. This approach has led me to invest in and develop single-family, multifamily, mixed-use, and hotel properties.

Other investors take an asset-driven approach, specializing in one property type across multiple markets based on demographics, economic conditions, and scalability.

Choosing the right property and project involves multiple factors—market demand, government regulations and incentives, risk tolerance, execution capacity, and access to capital all play a role in shaping an investment strategy. The key is aligning these factors with your strengths and long-term goals.

My thesis for this deal was:

✔ Urban infill, mixed-use development ✔ Emerging market with strong demand

✔ Value-add opportunity with room for appreciation ✔ Proximity to employment hubs

The New Haven rental market is strong, with demand being fueled by:

✅ Yale University & Science Park expansion – 14,000+ students & biotech growth

✅ Proximity to Yale-New Haven Hospital, a major employer

✅ Low multifamily vacancy rates – Less than 5% vacancy citywide

✅ Walkability & transit access – Close to Yale’s Red Line Shuttle

This project aligned with my investment thesis—a well-located, value-add asset with strong demand drivers.

2. Market Analysis & Due Diligence

Before committing, I needed real data to support my assumptions.

Market Research & Comparables I analyzed:

✔ Apartment Rents and vacancy rates – Nearby units rented for $1,800–$2,200 for one-bedrooms. Vacancy rate for apartments: 5%

✔ Retail Trends – The area lacked local coffee shops and convenience retail.

✔ Demographics – Young professionals, students, and biotech employees were driving demand.

Boots-on-the-Ground Research I walked the neighborhood, talked to local brokers, and visited nearby properties.

✔ New Haven was growing, but this intersection remained underdeveloped.

✔ Surrounding projects were thriving, proving this was a prime location for investment.

The data confirmed it—this wasn’t just a good deal; it was a strategic investment.

3. Underwriting & Structuring the Deal

Once I validated the opportunity, I needed to underwrite the project and structure financing.

Financial Model & Assumptions

Underwriting is where numbers meet reality—it’s the process of analyzing whether a real estate investment makes financial sense and mitigates risk before moving forward. This is where you validate your assumptions, stress-test the deal, and structure financing to ensure profitability. This were assumptions: